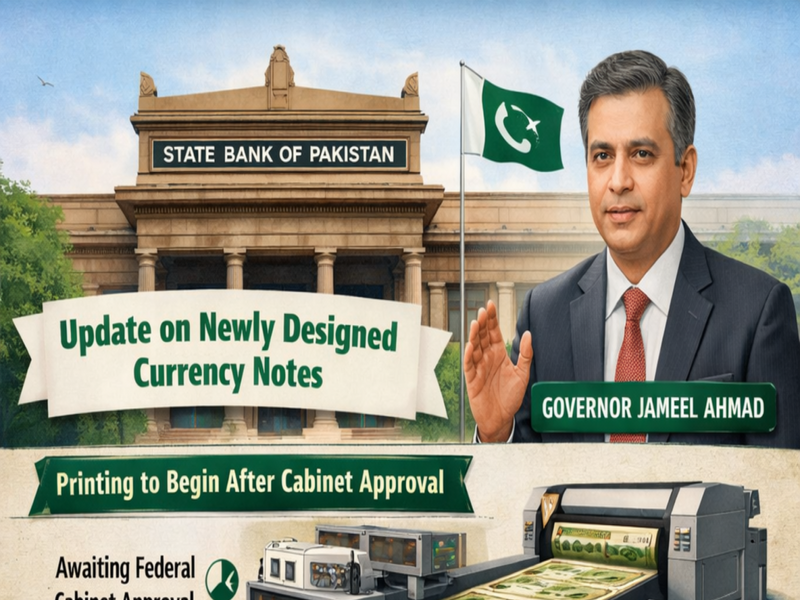

The State Bank of Pakistan has announced an important update regarding the introduction of newly designed currency notes. During a press conference following the latest monetary policy announcement, SBP officials confirmed that the design process is nearly complete, with printing scheduled to begin once the federal cabinet grants final approval. Cabinet approval is required before any new notes can be produced or released to the public.

SBP Governor Jameel Ahmad stated that the process is at an advanced stage, with plans to print two to three different denominations simultaneously. While the specific notes to be printed first have not been disclosed, the central bank emphasized that the new notes will be introduced gradually to avoid disruption. Initially, sufficient stock of the new notes will be printed, after which they will enter circulation in phases alongside existing currency, ensuring that both old and new notes remain valid during the transition period.

Currently, Pakistan has several denominations in circulation, including Rs 10, Rs 20, Rs 50, Rs 75, Rs 100, Rs 500, Rs 1,000, and Rs 5,000. The redesign process is being carried out in line with modern standards, incorporating advanced security features to combat counterfeiting and strengthen the country’s financial system. International experts have been consulted to ensure the new notes meet global requirements.

The new designs have already been submitted to the government and are under review by a special cabinet committee formed to examine the proposals in detail before final approval. The State Bank has assured the public that the transition to new notes will be smooth, well-managed, and fully secure, with no immediate need for concern.

Once cabinet approval is received, printing will commence, and the new currency notes will gradually enter the market, replacing old notes over time. This careful and phased rollout aims to maintain stability and continuity in Pakistan’s cash system while enhancing security and modernizing the nation’s currency.