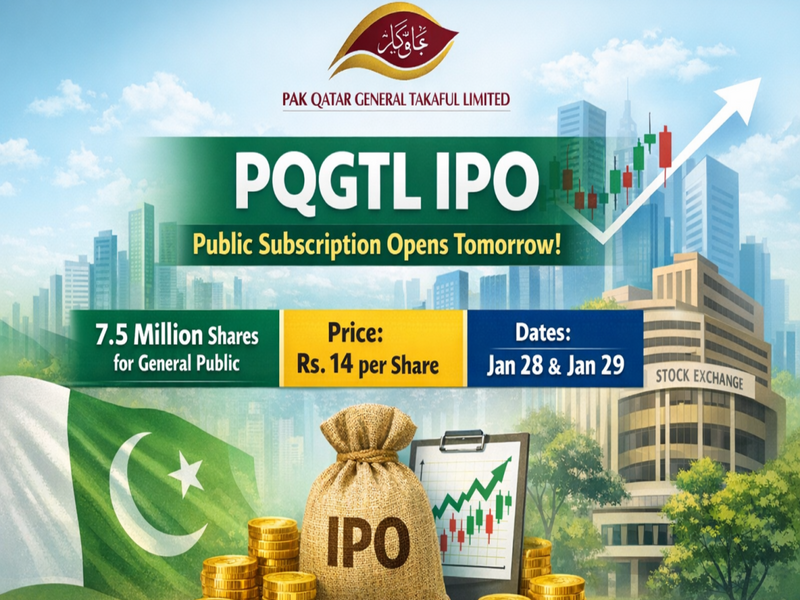

The general public subscription for the initial public offering of Pak Qatar General Takaful Limited, widely known as PQGTL, is set to open on January 28 following the successful completion of its book-building phase last week. The IPO has generated strong interest in the market, particularly among investors who closely monitor insurance and takaful companies in Pakistan, reflecting growing confidence in the sector.

This public offering allows retail investors to purchase PQGTL shares for the first time and become part-owners of the company. IPOs are often seen as an accessible entry point into the stock market for small investors because pricing is fixed and the application process is clearly defined. For PQGTL, a total of 7.5 million shares have been reserved specifically for the general public, representing 25 percent of the overall IPO size, ensuring fair participation for retail investors rather than limiting allocation to large institutions.

The strike price for the public category has been fixed at Rs. 14 per share, meaning all retail applicants will pay the same amount per share. This transparent pricing structure helps investors calculate their investment easily, making the IPO more approachable for first-time participants. The subscription window will remain open for only 24 hours, starting on January 28 and closing on January 29, so investors are encouraged to apply promptly to avoid missing the opportunity.

Investor confidence was clearly demonstrated during the book-building phase, where bids worth approximately Rs. 4.74 billion were received. This demand was nearly 21 times higher than the shares offered, making the IPO heavily oversubscribed. Such a response generally signals strong market confidence in the company’s business model and future growth potential.

The final strike price of Rs. 14 per share was determined after reviewing the demand during book building. Initially, the floor price was set at Rs. 10 per share, but strong investor interest justified a 40 percent increase. At this price level, the company is expected to raise around Rs. 420 million through the IPO.

Pak Qatar General Takaful Limited operates under the takaful model, which is based on Islamic financial principles. Takaful functions as a cooperative risk-sharing system where participants contribute to a common pool to support members facing losses. Because it avoids interest and complies with Shariah guidelines, takaful has gained strong acceptance in Pakistan’s financial market, adding to the long-term appeal of PQGTL.

The IPO has attracted attention due to a combination of factors, including strong institutional demand, an affordable and fixed share price for retail investors, and the overall growth potential of the takaful industry. However, investors should also be aware that oversubscription may result in shares being allocated through a balloting process, where not all applicants receive shares and refunds are issued accordingly.

While IPOs can offer promising opportunities, they also carry risks. Share prices can fluctuate after listing due to market conditions or company performance. Investors are advised to diversify their investments and commit only funds they can afford to keep invested over time.

The opening of the PQGTL general public subscription represents a notable opportunity for retail investors to participate in Pakistan’s growing takaful sector. With strong early demand and a structured offering process, the IPO provides both learning and investment potential, provided decisions are made with careful understanding and realistic expectations.